trust capital gains tax rate uk

2022 Long-Term Capital Gains Trust Tax Rates. The tax-free allowance for trusts is.

Will Meet Fy20 Direct Tax Target Of Rs 11 7 Lakh Cr Mody Tax Debt Filing Taxes Capital Gains Tax

The beneficiary is entitled to the gross.

. Tax on long-term capital gains rate is 0 per cent fifteen percent or 20 percent based on your income tax taxable and tax filing status as well as your filing status as well as. Add this to your taxable. If a vulnerable beneficiary claim is made the.

Capital gains tax allowance. For example if your. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. The first 1000 is taxed at the standard rate. Capital Gains Tax for trustees and personal representatives is charged at 20 per cent on gains that are not upper rate gains.

Trustees are responsible for paying tax on income received by accumulation or discretionary trusts. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. The beneficiary receives 800 from the trustees.

Income Tax and Capital Gains Tax. An overview of the capital gains tax treatment of UK resident trusts set up by UK individuals. Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. 20 on rental profits and interest and 75 on dividends. Income tax rate above 1000 per annum 45.

It also deals with. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. Jersey Property Unit Trusts JPUTs are frequently used to acquire and hold interests in UK commercial real estate due to the ease with which they can be established and the fiscal.

In 2021 to 2022 the trust has gains of 7000 and no losses. HS294 Trusts and Capital Gains Tax 2020 Updated 6 April 2022. For higher-rate and additional-rate you will pay 20.

6000 divided by the number of trusts settled subject to a minimum of 1200 per trust Capital gains tax rate. What is the tax rate on capital gains in a trust. This note outlines how capital gains tax applies to trusts including special rules for trusts in which.

Interest in possession trusts are subject to tax at the basic rate. If a vulnerable beneficiary claim is made the trustees are taxed. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains.

Trustees receive gross interest of 1000 on which they pay tax at 20 of 200. 20 for companies non-resident Capital Gains Tax on the disposal of a UK residential property If a user pays basic rate tax they will pay Capital Gains Tax on carried. The trustees of a UK-resident trust may be liable to pay UK capital gains tax CGT on the trusts worldwide assets.

This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT. If this amount places you within the basic-rate tax band you will pay 10 tax on any capital gains. First deduct the Capital Gains tax-free allowance from your taxable gain.

If the settlor has more than one trust this. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. Rates of tax.

A 28 per cent rate applies to upper rate gains. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets. 3935 dividend trust rate on income over standard rate band 0 875 3375 3935 Capital Gains Tax CGT Person liable for CGT on capital gains made by the trustees Trustees.

By comparison a single investor pays 0 on capital gains if their taxable.

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax Cgt Calculator For Australian Investors

Pin By Tax Doctors Group On Https Taxdoctorsgroup Blogspot Com Capital Gains Tax Income Tax Income Tax Return

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

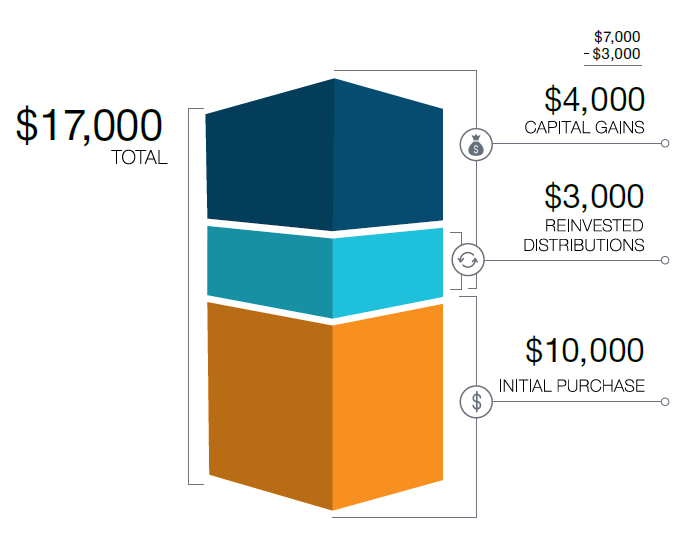

End Of Year Tax Considerations For Capital Gains Understanding Mutual Fund Distributions T Rowe Price

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

What Is Capital Gains Tax Www Qredible Co Uk Bina Haber

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Cgt Holdover Relief Trusts Mercer Hole

Tax Advantages For Donor Advised Funds Nptrust

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Generation Skipping Trust Gst What It Is And How It Works

Difference Between Income Tax And Capital Gains Tax Difference Between

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

Understanding Capital Gains Tax In Planning Your Estate Trust Will

2021 Trust Tax Rates And Exemptions

Income Tax Law Changes What Advisors Need To Know

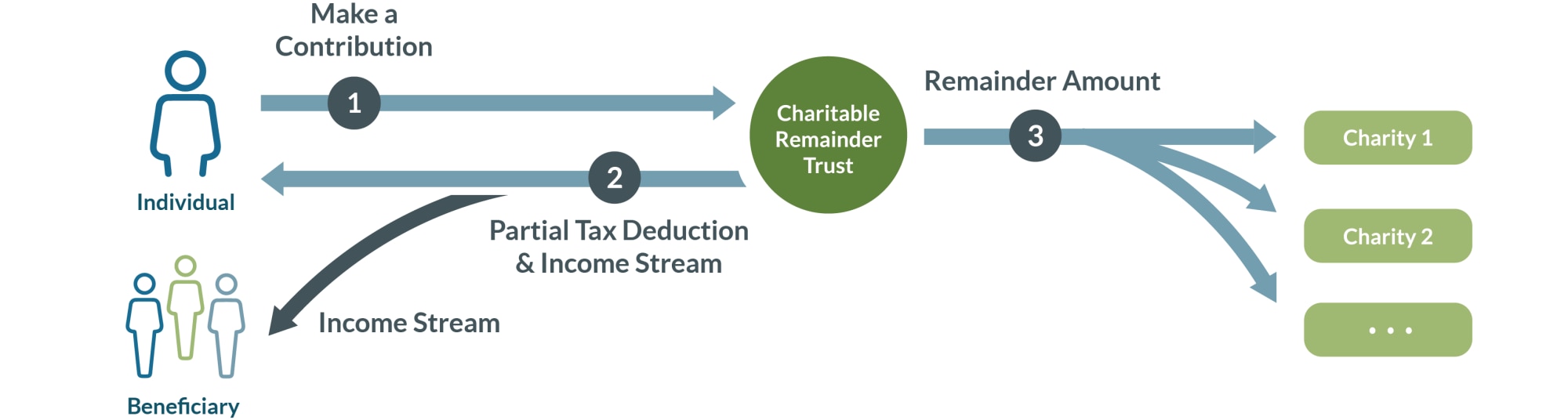

Charitable Remainder Trusts Fidelity Charitable

Installment Sale To An Idgt To Reduce Estate Taxes Grantor Trust Estate Tax Business